Personal Services Page

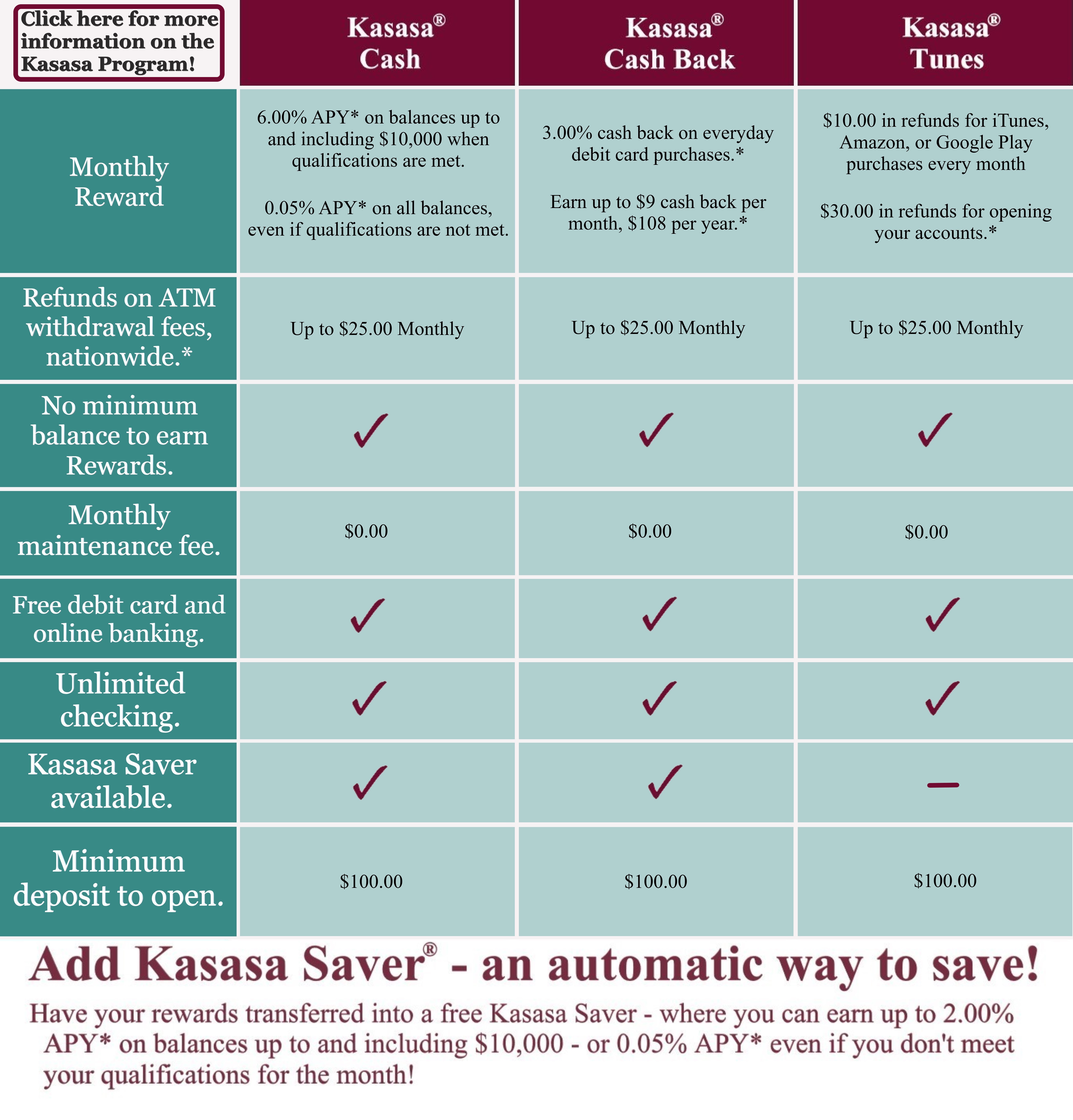

Kasasa Benefits Chart (Image) Details also on Kasasa Page, reached by clicking on image.

-

Kasasa Additional information, referencing asterisks on image.

* Additional Information-

APY

APY = Annual Percentage Yield. APYs accurate as of May 31, 2022.

Rates - Rewards - Bonuses

Rates, rewards, and bonuses, if any, are variable and may change after account is opened; rates may change without notice to you. No minimum balance is required to earn or receive the account’s rewards. Rewards less than a penny cannot be distributed. Fees may reduce earnings.

ATM Fees

You will receive reimbursements up to $25.00 for nationwide ATM withdrawal fees incurred within your Kasasa Cash, Kasasa Cash Back or Kasasa Tunes account during the Monthly Qualification Cycle in which you qualified. NOTE: ATM fee reimbursements only apply to Kasasa Cash, Kasasa Cash Back, or Kasasa Tunes transactions via ATM; Kasasa Saver ATM transaction fees are not reimbursed nor refunded. Depending on your Kasasa account, when your qualifications are not met, cash back payments are not made, iTunes, Amazon.com or Google Play purchases are not reimbursed, nationwide ATM withdrawal fees are not reimbursed and: Kasasa Cash: the entire average daily balance in the Kasasa Cash account earns 0.05% APY. Interest will be credited to your Kasasa Cash and Kasasa Saver accounts on the last day of the current statement cycle. The cash back payments and nationwide ATM withdrawal fee reimbursements earned in your Kasasa Cash Back account will be credited to your Kasasa Saver account on the last day of the current statement cycle. If Kasasa Cash or Kasasa Cash Back are linked to Kasasa Saver, the following also apply: Kasasa Cash: When linked to a Kasasa Saver account, the interest earned within the Kasasa Cash account does not compound since it, along with any nationwide ATM withdrawal fee reimbursements are, automatically transferred to the Kasasa Saver account within one day. This automatic transfer may cause an overdraft to your Kasasa Cash account, if the account balance is less than the transferred amount when the transfer occurs. Kasasa Cash Back: When linked to a Kasasa Saver account, the cash back payments and nationwide ATM withdrawal fee reimbursements earned in your Kasasa Cash Back account will be credited to your Kasasa Saver account on the last day of the current statement cycle.

Trademarks

Kasasa, Kasasa Cash, Kasasa Cash Back, Kasasa Saver and Kasasa Tunes are trademarks of Kasasa, Ltd., registered in the U.S.A.

Other checking accounts:

NOW account

NOW Account- Unlimited check writing

- Internet Banking & Phone banking

- e-Statements

- Internet Bill Pay Service

fees may apply - Debit Card for qualified applicants

- Overdraft protection for qualified applicants

- Interest earned on collected balance of $1,000 or more

- Monthly statement with images

- $10 monthly maintenance fee waived with deposit relationship accounts of $5,000

Minimum to open $1,000

Accounts powered by Bazing:

Enjoy protective and money-saving benefits from Farmers and Drovers Bank's Bazing program, including roadside assistance, cell phone protection, health savings, thousands of online deals with name-brand retailers, savings on hotels and car rentals, and more.

Prime account

Prime Checking- Unlimited check writing

- Internet Banking & Phone banking

- Debit card for qualified applicants

- e-Statements

- Internet Bill Pay Service

fees may apply - Overdraft protection for qualified applicants

- Full access to Bazing savings

saves you money on shopping, dining, travel and more - Interest earned on collected balance of $1,000 or more

5 free check deposits with mobile deposit per statement cycle - Free Money Orders

- Cell phone protection

receive up to $200 per claim ($400 per year) if your cell phone is broken or stolen - Identity theft protection

includes payment card protection, $2,500 in personal identity protection and identity theft aid - Roadside assistance

available 24/7 and free to use up to $80 in service charges - $10,000 of accidental death insurance

- Pharmacy, vision and hearing savings

- 1 Free box of checks per year

- $8 monthly maintenance fee waived with a balance of $5,000 or relationship balances of $50,000 or more

Minimum to open $100Choice account

Choice Checking- Unlimited check writing

- Internet Banking & Phone banking

- Debit card for qualified applicants

- e-Statements

- Internet Bill Pay Service

fees may apply - Overdraft protection for qualified applicants

- Limited access to Bazing savings

3 free deals from merchants to save you money on shopping, dining, travel and more - Interest earned on collected balance of $1,000 or more

- Mobile check deposit

2 free check deposits with mobile deposit per statement cycle - Free Money Orders

- $5 monthly maintenance fee waived with minimum daily balance of $1,000

Minimum to open $100Basic account

Basic Checking- Unlimited check writing

- Internet Banking & Phone banking

- Debit card for qualified applicants

- e-Statements

- Internet Bill Pay Service

fees may apply - Overdraft protection for qualified applicants

- Limited access to Bazing savings

3 free deals from merchants to save you money on shopping, dining, travel and more - $2 per month for monthly statement with images

sign up for e-Statements and we will waive the $2 monthly fee

Savings Account

- Interest earned on collected balance of $50 or more

- Interest is compounded and credited monthly

- $5 monthly maintenance fee waived if you maintain a balance of $250 or more

- Monthly maintenance fee waived for customers 18 and under

- Six free debits each statement cycle

$5 fee for each debit over six - Free Internet Banking & On-Line Teller

Minimum to open $50

Money Market Account

- Interest earned on collected balance of $2,500 or more

- Tiered interest rate

- Monthly statement with check images

- Debit Card for qualified applicants

- Six free debits each statement cycle

$5 fee for each debit over six - Internet Banking & On-Line Teller

- Notary Service

Christmas Club

- Only available from November 1st to October 10th!

Make 49 consecutive and timely weekly deposits of the same amount and we make 25% of the 50th deposit for you

Loan Services

- Real Estate Loans

- First Time Homebuyer Loans

- Mortgage Loans

- Home Equity Loans

- Building Improvement Loans

- Auto Loans

- Agricultural Loans

- Commercial Loans & Leases

Other Services

- Certificates of Deposit

- Individual Retirement Accounts

- Health Savings Accounts

- Trust Department

- Discount Brokerage Services (not FDIC Insured)

Other Benefits

- 24-Hour ATM

- Phone Banking

- Mobile Banking & Mobile Deposit

- Internet Banking & Bill Pay

- e-Statements

- Cashier's Check & Money Orders

- Notary Service

- Safe Deposit Boxes

- Direct Deposit

- Night Deposit

- Instant Issue Debit Card